No better than roulette. How foreign exchange trading rips off mum and dad investors

- Written by Mark Crosby, Professor, Monash University

In 2013 I wrote a piece on The Conversation[1] arguing that foreign exchange trading should be much more tightly regulated.

In particular, I said that retail (mum and dad) investors should only be allowed to trade foreign currencies in limited circumstances. Since then there has been little change. It is still shockingly easy for a retail investor with a very limited understanding of foreign currency to trade foreign exchange, as was demonstrated on ABC 7.30 on Wednesday night[2].

There is a basic difference between foreign exchange trading and other forms of investment such as share trading. Over time, share markets tend to rise, so that if an investor buys a diversified basket of shares, or even an individual share, they should expect a positive return over time. Of course markets go up and down, and individual share trades can go wrong, but in the long run the market tends to rise.

Share trading it isn’t

Foreign currency markets are fundamentally different, in that there is no reason to expect exchange rates such as the Australian-US dollar rate to rise or fall over any short- or medium-term trading horizon.

For 30 or more years, academics have tried to build models to predict exchange rates. None of them work. If even the most sophisticated academic or trader built a model to predict whether the AUD/USD would go up or down tomorrow, they would get it wrong 50% of the time – exactly the same as a coin toss. This means trading foreign exchange on the basis of whether major currencies will go up or down is exactly the same as playing two-up[3]!

Losses can exceed what you put in

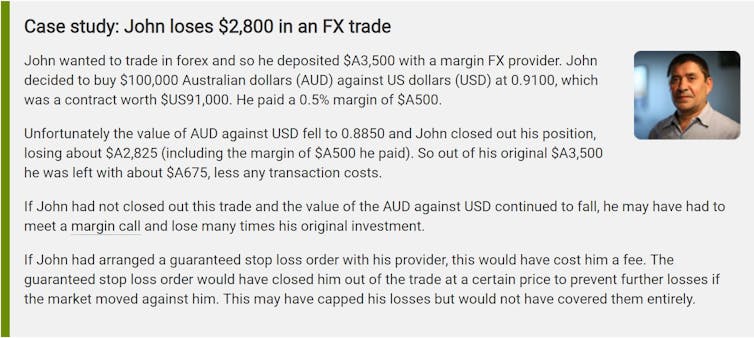

The second reason that retail investors should be wary of foreign exchange trading is that many promoted products are highly leveraged - funded by borrowing. The Australian Securities and Investments Commission has clear warnings about foreign exchange trading[4] on its Moneysmart webpage, including a case study of a typical trader who invests A$500 to borrow to buy A$100,000 at an exchange rate of 91 US cents.

With this contract, a fall in the USD/AUD exchange rate to 88.5 US cents sees this trader lose A$2,825, meaning they have to pay another A$2,325 in addition to the original A$500 to close out the contract.

How to lose a lot from a little.

ASIC MoneySmart[5]

How to lose a lot from a little.

ASIC MoneySmart[5]

If foreign exchange trading is so risky, and in my view no different to playing two-up or roulette, why do we allow retail investors to leverage into these products?

The problem, as I see it, is that regulators can take one of two approaches to investors. The traditional view is that if investors have enough information they will make informed choices in their own best interests. Economists describe this as behaving rationally. The ASIC approach is very much based on this view: provide good information and let investors make informed choices.

Information isn’t enough

There is a second view that is gradually replacing this view of individuals as rational. The “behavioural economics” approach examines the psychology and actual approaches of individuals in different circumstances, to explore departures from rationality. Unsurprisingly, in many arenas people are irrational, creatures of habit, ill-informed, and so on.

An implication is that sometimes people ought to be protected from their own poor decisions, even though that might limit choice. I would argue strongly that there is no reason for retail investors to trade foreign exchange, and certainly no reason to borrow to do it. Measures to limit such trading, except in circumstances where an investor can demonstrate their expertise, ought to be encouraged.

We’re a magnet for promoters

This is very far from the case in Australia currently. In fact Australia is seen as an attractive location for firms offering retail foreign exchange trading. Websites offer “training and tips” and then allow trading inside 24 hours.

I have spent 30 years studying foreign exchange markets and would still say that I’m not sophisticated enough to trade them. Maybe I’m dumb, but I’m not crazy enough to trade foreign exchange.

Read more: Gambling on the dollar: time to reign in forex trading[6]

References

- ^ piece on The Conversation (theconversation.com)

- ^ as was demonstrated on ABC 7.30 on Wednesday night (www.abc.net.au)

- ^ two-up (en.wikipedia.org)

- ^ clear warnings about foreign exchange trading (www.moneysmart.gov.au)

- ^ ASIC MoneySmart (www.moneysmart.gov.au)

- ^ Gambling on the dollar: time to reign in forex trading (theconversation.com)

Authors: Mark Crosby, Professor, Monash University